The Organization of Petroleum Exporting Countries (OPEC) has announced that the commencement of operations at Nigeria’s Dangote refinery and Mexico’s Dos Bocas refinery could significantly impact gasoline producers in the United States and Europe. Historically, these regions have been primary markets for refined petroleum products, particularly premium motor spirit (PMS).

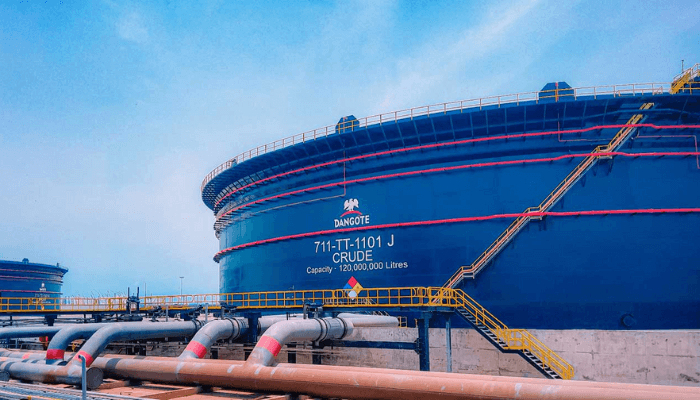

According to recent findings, the Dos Bocas refinery is designed to process approximately 340,000 barrels per day (bpd), positioning Mexico toward self-sufficiency in refined petroleum. Meanwhile, the Dangote Oil Refinery boasts an impressive capacity of 650,000 bpd, aimed at fulfilling demands across Nigeria and the broader West African market.

In its latest 2024 World Oil Outlook, OPEC emphasized that these new mega-projects are set to reshape the international downstream market. The report stated: “The start-up of the Dangote refinery and the upcoming commercial launch of the Dos Bocas refinery could significantly affect the gasoline market in the Atlantic basin.” As both regions currently import substantial volumes of gasoline, the full operation of these refineries may lead to a paradigm shift in the market dynamics, particularly affecting US and European refineries, which are already experiencing stagnation.

The report also highlighted the strong influence of geopolitics on the downstream market. For example, the European Union’s embargo on Russian crude and product exports has altered interregional oil flows, prompting EU refiners to increase crude oil imports from the US and the Middle East. Additionally, EU imports of non-Russian products have surged from India, the US, and the Middle East, with newly commissioned plants in the region exporting diesel to the EU.

Commenting on the OPEC findings, NJ Ayuk, Executive Chairman of the African Energy Chamber, remarked, “Nigeria is starting to emerge as a key player in the global trade of middle distillates and light ends.” He noted that the Dangote refinery is poised to rival some of the largest refining sites in the US and is more than 50% larger than Europe’s biggest refinery.

While Ayuk acknowledged the potential challenges of ramping up refinery operations, he expressed optimism about the transformative effect of these refineries on fuel markets in West Africa and their implications for trade flows in Europe. “Nigerian refined products will soon be making their way into Northwest Europe, traditionally an exporter,” he stated.

As these refineries move closer to full operational capacity, their impact on global refined petroleum markets could be profound, reshaping trade dynamics and altering long-standing dependencies.